Treasuries, Teraflops & Terawatts

How open agent standards, the new stablecoin & AI federal mandates and debt can ignite a Money + Machines supercycle

Nothing here is legal or financial advice.

Shortly after working to advance open rails for the agentic future at MIT, I watched as the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins Act) was enacted, opening up payment rails in the US. As the Economist put it, this big bang will revolutionize finance. Anchorage is now building a stablecoin issuance platform onshore, starting with Ethena (now the third largest stablecoin). Western Union is contemplating its own stablecoin upgrade. VISA expanded stablecoin settlement. And JPM announced it is partnering with Coinbase to facilitate crypto access via USDC. Meanwhile, the White House also published its AI Action Plan, prioritizing open models and open weights while fast-tracking energy and data center permitting. Timing feels ripe to unpack these developments and possible ripple effects beyond stablecoins, especially because both sit at the heart of the crypto and AI convergence I have been exploring lately.

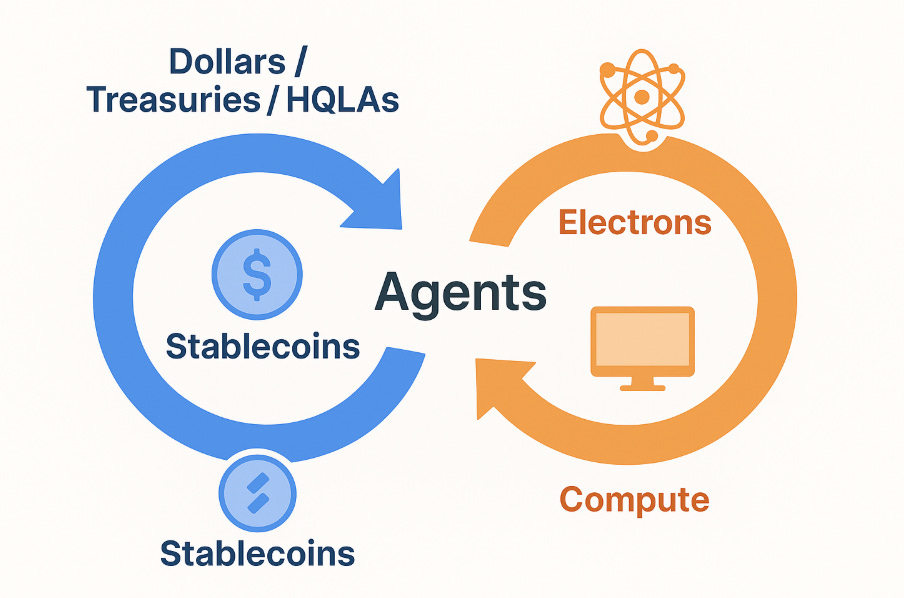

TL;DR: The GENIUS Act hard‑codes reserve integrity and pushes stablecoins into the banking perimeter while the AI Action Plan clears the path for an energy‑and‑compute build‑out, enabling a modular, interoperable ‘money + machines’ Cambrian flywheel (where stablecoins facilitate seamless payments and AI infrastructure powers agentic computation) that should accelerate unbundling across the internet value chain.

1. The GENIUS Act: Hard-Codes Dollarization and Interoperability

First, a quick recap: GENIUS establishes the first federal framework for payment stablecoins—digital tokens pegged to fiat like the USD. It mandates 1:1 reserves, aligns state and federal regs to reduce fragmentation, narrowly greenlights pathways for permitted stablecoin issuers, disallows rehypothecation or interest payments to holders, and affords them superpriority in bankruptcy. This isn't just about crypto safety; it's a deliberate move toward modularization, echoing post-GFC reforms like Dodd-Frank that forced transparency around, and ringfenced, structured credit. It effectively legislates a 24/7, API‑addressable, dollar clearing layer that will be subject to interoperability standards to be developed in consultation with NIST (cue corresponding interoperability standard-setting at the agentic layers). It might even be easy (albeit imprecise1) to loosely think of it as turning stablecoins into the "HTTP of money" for agentic communications and commerce in a world where most online work is done by agents. By hard-coding dollarization and interoperability, GENIUS not only upgrades settlement infrastructure but sets the stage for AI agents to transact fluidly—enter the White House's complementary push on physical infrastructure.

2. The AI Action Plan: Programmable Money Rails Meet Infrastructure Expansion

The AI Action Plan—formally "Winning the AI Race: A National Strategy for American Leadership"—outlines a deregulatory, pro-growth approach toward American AI dominance. Key pillars include:

Infrastructure Expansion: Fast-tracks nuclear reactors and other infrastructure projects to service ballooning compute needs.

Deregulation and Innovation: Slashes "red tape" on AI development, bans ideological bias in models, and funds R&D via public-private partnerships—aiming for "full-stack American AI" (hardware & software).

Global Export and Security: Exports US AI while imposing controls on adversaries.

Economic Ties: Links AI to job creation and capital markets, calling for a mature market in compute.

This overwhelming support for compute infrastructure, open models, and deregulation isn't just policy—it's a call to action for capital markets to fund the massive build-out required, as we'll explore next.

3. Capital Market Developments

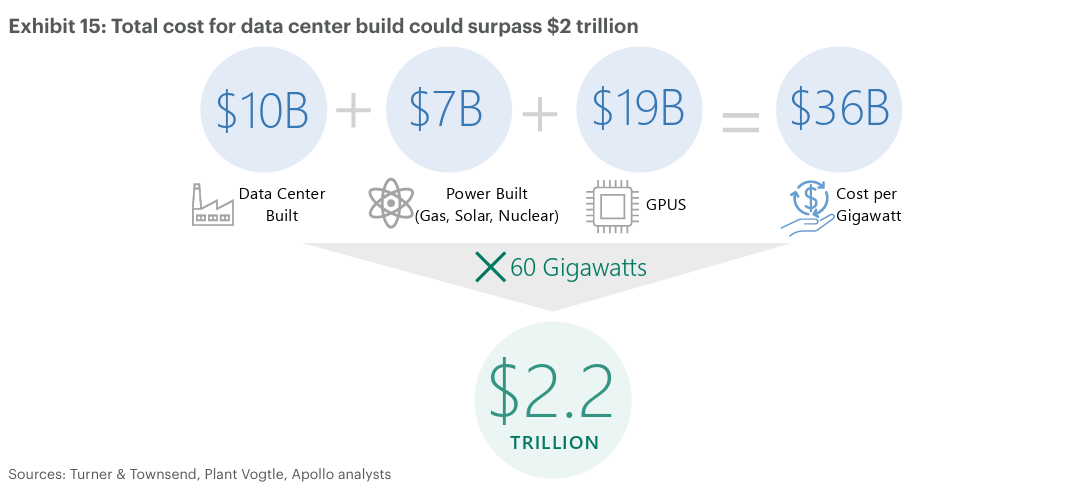

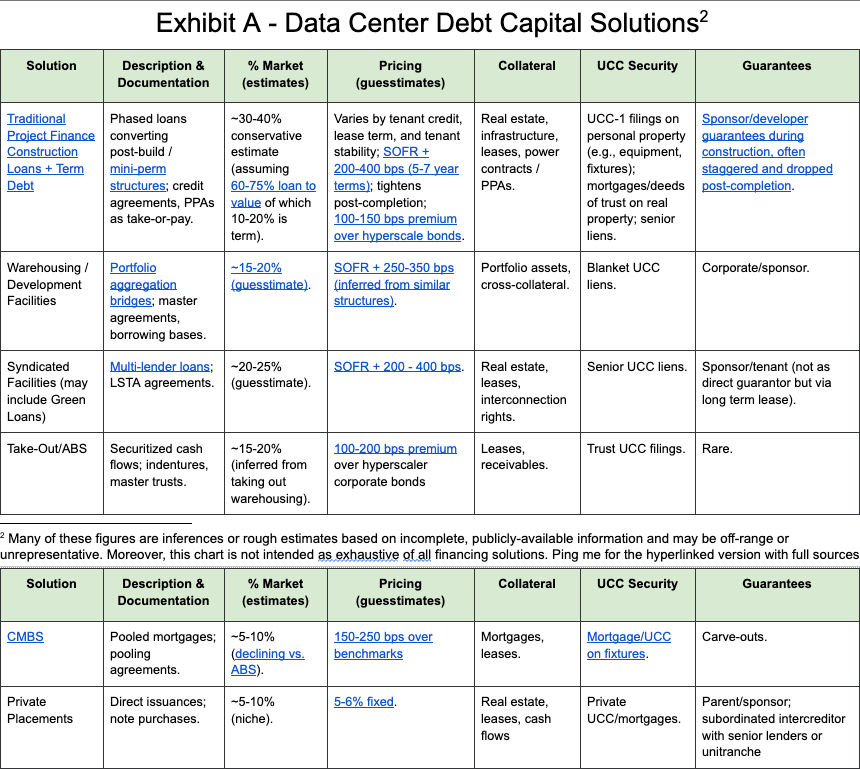

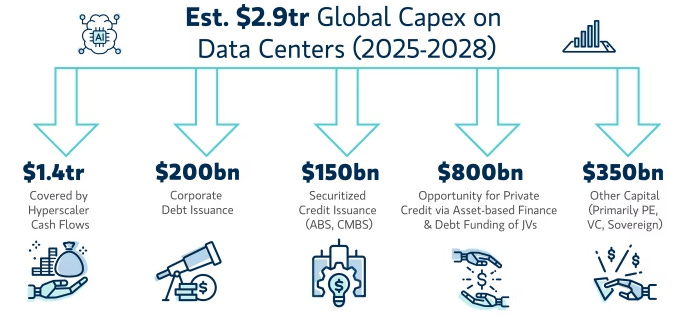

Compute demands are enormous and increasing (not to mention stressful to the grid); McKinsey reports that global demand for data center capacity could almost triple by 2030, with about 70 percent of that demand coming from AI workloads. The US power market is likely to need another 150 to 250 terawatt hours of electricity by 2030 – the equivalent of bringing another NYC online just for data centers. Leading public bitcoin miners like MARA, RIOT, HUT8 and Coreweave saw the opportunity and have increasingly pivoted to HPC data centers, whereby they can exploit power interconnects and arbitrage their 6-12x EV/EBITDA valuation with current 20-25x multiples. Private equity including Blackstone, KKR, Bain, CPPIB, Silver Lake and other prominent players are capitalizing accordingly. Financing avenues run the gamut from access to capital markets, commercial banks, permanent capital and the private credit markets (with some observers raising systemic concerns of a budding credit bubble). As someone who structured credit facilities, capital call lines, securitizations, and project financings in a past life, I see familiar toolkits resurfacing here – see Exhibit A for a detailed breakdown of debt capital solutions options for a market where debt is mission-critical (typically 65-80% of costs), and please ping me for the hyperlinked version if helpful. It will be interesting to watch stablecoins streamline capital intensive development projects like these, as well.

Source: Apollo

Note that one long-neglected power source is nuclear for which fewer debt financing or other options traditionally apply. One interesting cost mitigation technique however might come from the EU, where cooperative financing models (which also cohere with the open source ethos of decentralized networks soon to underpin the global economy in virtue of GENIUS) have been deployed to enable stable, long-term funding for data centers through shared equity, cost-based electricity distribution, and take-or-pay agreements that reduce exposure to overruns while stabilizing energy prices - effectively unbundling the construction / infrastructure development stack. Kudos to Standard Nuclear for their pilot here. Ultimately, these developments position capital markets as the engine of the supercycle, where treasuries (via stablecoins), teraflops (AI compute), and terawatts (energy) converge.

Conclusion + CTA

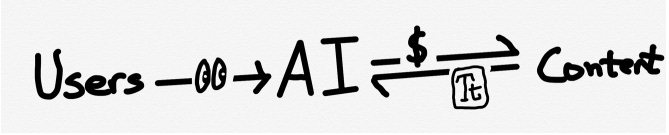

Jim Barksdale (then CEO of Netscape) has a famous pithy but timeless insight that all businesses toggle between a bundling and unbundling loop, which applies as much to market structure. I find arguments that we are in an unbundling era compelling, and applicable from the app level down to the settlement layer, now that cash functionality is franchised out to stablecoin issuers interoperably. This of course extends beyond the consumer attention economy to enterprise as well – imagine modularized and interoperable enterprise app stores like Mezzanine.xyz or other superapps aggregating, building and facilitating expanded ERP utilities at fractions of existing costs, enabling enterprise scale and distribution at lightning speed.

If you are working on this unbundling, are interested in advancing open standards, or otherwise want to collaborate, please ping me.

Credit: Ben Thompson, Stratechery, The Agentic Web and Original Sin (illustrating micropayments that GENIUS facilitates across an agentic web)

Exhibit A - Data Center Debt Capital Solutions

Source: Morgan Stanley, via FT

Ignoring the technical imprecision that stables live at the settlement layer like SWIFT/FedNow rather than the app layer where HTTP packets help apps communicate